Table of Contents

Introduction

Bitcoin and Ethereum are undoubtedly the two most discussed cryptocurrencies in the rapidly growing sphere of digital money or finance. Although both of these cryptocurrencies are built on blockchain technology and decentralized digital currencies, yet differ in terms of uses, capabilities and technological structures. Whenever planning to invest in cryptocurrency or are interested in how these two giants compare to each other, it is essential to comprehend the difference between Bitcoin and Ethereum. Bitcoin was introduced in 2009 and became the leader of cryptocurrency, a digital alternative to conventional currencies. In 2015, Ethereum introduced the fundamental concept of blockchain to develop a decentralised computing platform. Therefore, understanding the difference between Bitcoin and Ethereum helps in choosing the most useful and widely accepted cryptocurrency. The blog will discuss major differences, potential applications, advantages and disadvantages which might be primarily suitable for several users and investors.

Origin and Purpose

Bitcoin – The Digital Gold

Bitcoin was developed by an anonymous developer or group under Satoshi Nakamoto and introduced to the world in a 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” It was officially launched in January 2009 following the mining of the Genesis Block, or Block 0. Bitcoin was especially designed to provide a new financial system that enables users to carry out their transactions without depending on financial institutions or banks. It was considered a deflationary asset because of its decentralized nature and its maximum supply of 21 million coins. Furthermore, Bitcoin is not only a means of exchange, instead perceived as a store of value, which gave it the nickname of digital gold. It has now been observed to be an anti-inflationary money by several investors during financial instability, especially in the form of hedge against inflation of the fiat currency. The major focus of Bitcoin is security, decentralisation, and immutability, which makes it a cornerstone in the entire cryptocurrency world.

Ethereum – The Smart Contract Platform

Ethereum was proposed at the end of 2013 and was developed by Vitalik Buterin and co-founders Gavin Wood and Charles Hoskinson. Ethereum began operation in 2015, and its vision was larger compared to Bitcoin. However, Bitcoin was aimed at transferring values, whereas Ethereum implemented the idea of the programmable blockchain using smart contracts, which are self-enforcing agreements written into the system. These smart contracts played a pivotal role in a new era of decentralized applications (dApps), which can disrupt industries such as finance, real estate, games, and supply chains. Ethereum was not created with the sole intention of money transfer, but to decentralize the infrastructure of the internet, primarily known as Web3. Therefore, this functionality enables Ethereum to foster innovation, such as DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens). Its semi-flexible architecture and active developer community make the platform one of the most powerful blockchain ecosystems.

Difference between Blockchain and Ethereum in terms of Technology

The blockchain of Bitcoin is designed by focusing on various aspects, including security, transparency, and decentralization. It uses a Proof-of-Work (PoW) mechanism that enables miners to unravel cryptographic puzzles for validating transactions and adding them to the blockchain. Such a system ensures the security of the network and cannot be tampered. However, the blockchain of Bitcoin is restricted in functionality by design; it supports a simple scripting language that is completely non-Turing and does not support complex loops. This restriction might result in improving security and reliability since some features translate into a shorter number of vulnerabilities. Blockchain can be visualized as a digital ledger, in the case of Bitcoin, that helps in recording transactions in chronological order. Its design aids in optimizing the value transfer and not the execution of applications or smart contracts. Therefore, the blockchain of Bitcoin can be considered as inflexible yet powerful, thereby excelling in its niche as a peer-to-peer cash system, thus sacrificing flexibility to maintain stability and predictability.

Ethereum has improved upon the principles of blockchain by incorporating a fully programmable virtual machine called as Ethereum Virtual Machine (EVM). This innovation enables software developers to design decentralized software applications that can perform in a specific way they are programmed, and can never fail due to downtime, censorship or interference by the third-party. The programming language used in Ethereum, Solidity, is Turing-complete, allowing it to perform difficult computations and logic functions. This makes Ethereum more flexible than Bitcoin, thus supporting extensive utilization of the use cases, including token issuance (ERC-20), lending platforms, and decentralized exchanges (DEXs). However, the increased functionality becomes more complex and vulnerable to bugs. As Ethereum is programmable, it also needs higher computational power, which contributed to higher transaction fees and slow speed- a situation that Ethereum is trying to resolve via layer 2 and events such as sharding. However, the blockchain of Ethereum can also be regarded as a flexible and continuously developing platform for the decentralized digital economy.

Currency – Bitcoin vs Ethereum

Bitcoin supply is fixed at 21 million coins, an aspect incorporated in the protocol to guarantee scarcity. This scarcity resembles precious metals (such as gold), and the qualities of Bitcoin help it become a deflationary asset, which reflects that its value might increase with time because of growing demand and scarcity. However, in contrast to fiat currencies printed by the central banks, Bitcoin supply is severely controlled using a process known as halving that results in minimizing the reward for mining every four years. This predictable monetary policy has made Bitcoin (BTC) a good place to store money and a hedging tool against inflation, particularly during downturns of fiat currency. The institutional investors and the big companies such as BlackRock, Tesla and MicroStrategy have noticed this value and included BTC within their balance sheets. Although it is possible to use Bitcoin as a method of payment, most Bitcoin holders now consider it a form of digital gold that is more suitable for investment in the long term compared to daily transactions. This is primarily due to the slow speed of transactions and higher fees compared to various other currencies.

In contrast to Bitcoin, the supply of Ethereum is not fixed, which initially raised the issue of inflation. In 2021, however, EIP-1559 was implemented, which introduced an Ethereum burn mechanism that destroys part of the transaction fees (paid in ETH) permanently, and results in creating deflationary pressure when the network is active. ETH is more than a digital currency, which is used as a form of fuel to run the Ethereum network that enables users to connect with DeFi protocols, smart contracts, and decentralized applications. Regardless of minting NFTs and trading on a decentralized exchange platform, such as Uniswap, users will require ETH to pay for computational resources. However, this unique role enables ETH to become a utility token instead of a store of value. The ecosystem of Ethereum has grown significantly due to the rapid institutional adoption, dApps and Layer 2 solutions. This utility-driven demand reinforces its position as a potential asset in the blockchain space, particularly for the users, investors and developers involved with Web3.

Application and Use Cases

The vision of Bitcoin, as outlined by Satoshi Nakamoto, was to act as a peer-to-peer electronic cash system. Although it plays a pivotal role in storing value and might be used as a medium of exchange, especially in regions experiencing limited access to banking, economic instability and hyperinflation economies. Countries such as El Salvador, where Bitcoin was introduced as a legal currency, depict the effective use of Bitcoin as a medium of exchange in everyday transactions. Moreover, Bitcoin often uses international remittance because conventional services are expensive and take time to settle. The transaction speed of Bitcoin has also increased due to the lightning network, but the fees have decreased significantly, allowing micro-transactions to be more viable. Furthermore, non-profit institutions and non-governmental organizations utilize Bitcoin in crisis zones to ensure security. Despite certain restrictions on scalability, Bitcoin is the most popular and commonly accepted cryptocurrency adopted by various merchants within fintech systems such as PayPal and Cash App, which further promotes its utility as a digital currency.

The most salient attribute of Ethereum is its ability to host programmable smart contracts that act as building blocks of decentralized applications (dApps). These applications tend to operate on the Ethereum Virtual Machine (EVM) and span across various sectors, such as gaming, identity verification, decentralized finance (DeFi), real estate and digital art using NFTs. Ethereum programmability is directly responsible for the emergence of platforms such as OpenSea (NFT marketplace), Aave (dec acrosside), Uniswap (automated trading), and Uniswap (automated trading). It is also possible to launch new tokens with Ethereum using the standards, such as ERC-20 and ERC-721, that enable developers to launch new projects. Moreover, Ethereum plays a detrimental role in the development of Web3, which focuses on developing a more decentralized internet controlled by the users. Continuous innovations in layer 2 rollups and the emergence of account abstraction, Ethereum is becoming the preferred platform among developers seeking to design powerful and decentralized ecosystems. Additionally, the vibrant community and continuous upgradation in protocol ensure that it stays at the forefront of innovation in blockchain technology.

| Feature | Ethereum | Bitcoin |

|---|---|---|

| Purpose | Decentralized applications and smart contracts | Digital gold and peer-to-peer currency |

| Consensus | Proof-of-stake (Ethereum 2.0) | proof of Work |

| Speed | faster transactions (approx 12 seconds) | slower transaction (approx 10 minutes) |

| Flexibility | Highly programmable | Limited programmability |

Disadvantages of Bitcoin

1. Lack of Scalability

The processing speed of transactions is one of the critical disadvantages of Bitcoin. The block size and 10-minute interval of the Bitcoin network will only allow to manage 3 to 7 transactions per second (TPS). This makes it considerably less scalable compared to conventional payment systems such as Visa, which can significantly contribute to processing multiple transactions per second (TPS). Consequently, the transaction fees increase rapidly and confirmation time becomes slow during a surge in demand, thereby making everyday use cumbersome.

2. Consumption of Energy

Bitcoin utilizes a Proof-of-Work (PoW) system, which requires intense computational power and electricity. The practice of Bitcoin mining has been criticized in terms of the impact on the environment, with some reports that the amount of electricity consumed by the Bitcoin network is equal to that used by several countries annually. Although the trend has shifted towards integrating the sources of renewable energy, still ecological footprint remains a major issue.

3. Lack of Functionality

The scripting language of Bitcoin is restricted to increase security. This limits its application to perform simple transactions, though it cannot be used to support advanced applications such as smart contracts. This implies that the current uses of Bitcoin are confined to its store of value or medium of exchange, thereby restricting its potential to drive growth compared to various other platforms.

4. Poor Upgrades and Slow Development

Bitcoin is slow to adapt to upgrades because of its decentralized governance and conservative advancement team. Proposals have to be thoroughly reviewed and agreed on by the community, which helps in improving stability, but also is accompanied by the fact that the platform will frequently be lagging in adapting to the changes in technology.

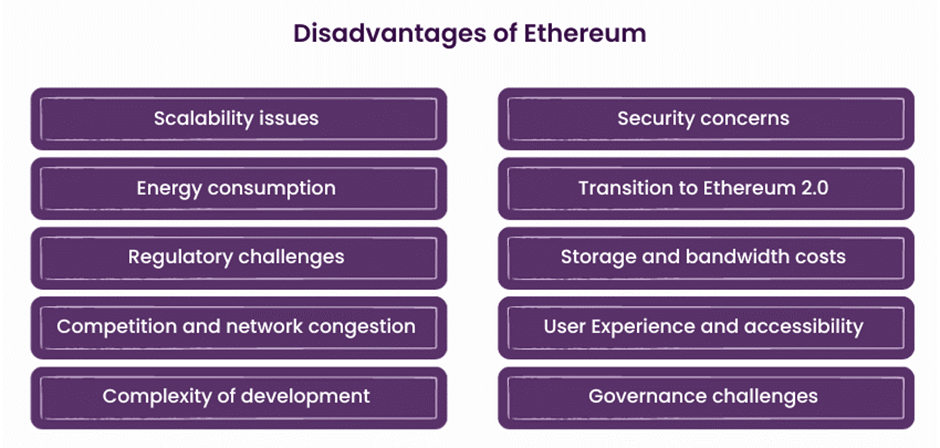

Disadvantages of Ethereum

1. High Transaction Fees

The most noticeable operational challenge of Ethereum is the constantly fluctuating high transaction fee. The popularity and demand of the network increase the fees to unreasonable costs during high usage and network traffic. This reduces the accessibility of Ethereum to smaller users and affects micro-transactions by the developers with limited budgets.

2. Issues of Scalability

Ethereum can process 15-30 TPS; however, it is insufficient for mass adoption. Although technologies such as Layer 2 rollups, sharding are being developed, but not been fully implemented. Ethereum still encounters challenges of scalability, due to which users will face congestion in networks and inefficiencies.

3. Security Vulnerability in Smart Contracts

The programmability of Ethereum is a two-sided battle. Although it facilitates a diverse ecosystem of dApps and DeFi protocols, it results in creating vulnerabilities and issues in smart contracts. Various high-profile hacks and exploits have led to the loss of millions of dollars. Compared to Bitcoin, which is rather stable and fixed, Ethereum is deficient in its complexity and makes it prone to coding errors and breaches in security.

4. Uncertain Regulatory Future

Ethereum, linked to DeFi, NFTs, and tokenization, encounters scrutiny from regulators, especially in the United States. It is unclear whether ETH and other tokens minted on the platform are securities, thus causing legal uncertainties that might hamper the adoption and valuation of the market.

Conclusion

Overall, Bitcoin and Ethereum have revolutionized the way users perceive the future of decentralized systems, money and technology. Both of these platforms have established specific roles in the cryptocurrency environment, being a store of value and digital gold (Bitcoin), while Ethereum is a programmable chain driving decentralized applications and smart contracts.

The relative strength of Bitcoin includes simplicity, limited supply, and being the most secure currency for institutions and investors seeking to hedge against inflation. However, issues in scalability, energy-consuming mining activity and limited functionality result in limiting the utility beyond being used as a medium of exchange and a means of storing value. In comparison, Ethereum is more versatile since it has a rich developer community that supports DeFi, NFTs, and Web3 technologies. Its transition to Proof-of-Stake has resolved the key energy issues and offers new opportunities concerning scaling and sustainability. Ethereum also encounters potential challenges such as high transaction fees, vulnerability in smart contracts, and regulatory complexity.

In any case, the choice between Bitcoin and Ethereum depends on various goals. Bitcoin is a good choice when users seek longevity and stability. However, in case the users want to participate in transforming the digital economy and utilizing blockchain for transactions, Ethereum offers an unmatched prospect. Several investors appreciate keeping both assets that help diversify the portfolio of crypto. Bitcoin and Ethereum will remain a significant part of the digital financial and decentralized innovation as the industry continues to evolve further.

Thank you for the auspicious writeup It in fact was a amusement account it Look advanced to far added agreeable from you However how can we communicate

you can check my contact details on my website.

Your blog is a testament to your expertise and dedication to your craft. I’m constantly impressed by the depth of your knowledge and the clarity of your explanations. Keep up the amazing work!

Wonderful web site Lots of useful info here Im sending it to a few friends ans additionally sharing in delicious And obviously thanks to your effort

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

I just could not leave your web site before suggesting that I really enjoyed the standard information a person supply to your visitors Is gonna be again steadily in order to check up on new posts

Your blog is a testament to your dedication to your craft. Your commitment to excellence is evident in every aspect of your writing. Thank you for being such a positive influence in the online community.

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers

Your blog is a constant source of inspiration for me. Your passion for your subject matter is palpable, and it’s clear that you pour your heart and soul into every post. Keep up the incredible work!

I do not even know how I ended up here but I thought this post was great I do not know who you are but certainly youre going to a famous blogger if you are not already Cheers